Did you know that customs procedures are not only important for INCON-LOGISTIC Ltd., but you might also be affected?

The topic of customs has long been a recurring subject in our everyday conversations, considering how much we order from abroad. Take Temu, Amazon, or Aliexpress as examples. Since July 1, 2021, customs duties must be paid for every item that arrives from outside the European Union, even if, for instance, you don’t have to pay separately on the Hungarian Post’s website. How does customs manifest for these products? Read our article, and you will learn all the useful information about it!

Why is the imposition of customs duties important?

Customs duties play an important role in the EU economy, among other things. They promote revenue generation for governments, which fund public services and infrastructure development. Customs duties help maintain trade balance, protect local industries, and ensure that exported and imported goods meet regulatory and quality requirements. In addition, they allow for the collection of trade statistics, which are important for evaluating economic performance and formulating trade policies. Customs duties also serve to strengthen international trade relations and reduce illegal trade. Overall, customs duties are essential for maintaining a stable and efficient trading environment in the EU.

What is the difference between customs and taxes?

Customs Duties: Customs duties are fees imposed by a government on imported goods, calculated based on the value and nature of the product. The purpose of customs duties is to protect domestic industries, control imports, and maintain economic stability. They are collected during customs clearance, and they must be paid before the goods are released for free circulation in our country.

Tax Burdens: Tax burdens refer to various taxes, such as value-added tax (VAT) or goods and services tax (GST), which are levied during the sale of goods and services. These taxes significantly contribute to state revenues and are typically calculated as a percentage of the purchase price. Similar to customs duties, tax burdens are essential for ensuring compliance with tax regulations and for funding public services.

What types of customs duties are there?

-

Ad Valorem Duty: This type of duty is calculated as a percentage of the FOB (Free on Board) price of the shipped goods. If the duty rate is 10% and the value of the goods is 1,000 USD, then the ad valorem duty equals 100 USD. The term “ad valorem” can be translated into Hungarian as “arányos vám,” which refers to the fact that the duty rate is determined as a percentage of the product’s value. The ad valorem duty is typically calculated based on the commercial value of the product and is widely applied in the customs clearance of imported goods.

Combined Duty: The combined duty is a combination of ad valorem duty and specific duty. An example of a combined duty could be an ad valorem rate plus 2 USD per weight unit. This is always defined in tax legislation.

Anti-dumping Duty: This duty is imposed only when an importer imports a product at a price lower than the expected production value, thereby harming local producers of similar goods. The purpose of the anti-dumping duty is to protect local producers by increasing the cost of dumped goods, bringing the import prices closer to the prices of locally produced products. This falls under the category of protective duties, and its aim is to deprive the importer of the price advantage derived from the low acquisition cost calculated with the anti-dumping duty.

Import Duty: The import duty is the fee imposed by the tax authority on goods brought into the country under customs legislation. The purpose of import duties is to protect local industry from foreign market competition and to provide necessary revenue for the state.

Export Duty: This is collected on goods leaving the country. These duties are generally applied when the government wants to restrict the outflow of national resources or encourage domestic processing. Export duties are rare since most countries support the export of their products abroad.

Specific Duties: Specific duties are fees applied to certain groups of goods to address various market aspects, such as anti-dumping duties or health/environmental duties. These duties are typically introduced under specific circumstances, such as the protection of national security or conservation regulations. As the name suggests, specific duties are set at a fixed amount based on weight, volume, or quantity, and unlike ad valorem duties, they do not vary with market prices.

What is CBAM?

The CBAM (Carbon Border Adjustment Mechanism) is a central element of the European Union’s ‘Fit for 55’ green legislative package, which can be interpreted as an EU-wide CO2 tax mechanism. Its aim is to support decarbonization strategies and prevent carbon leakage. Carbon leakage occurs when carbon prices and other EU measures create increased costs and competitive disadvantages in emission-intensive industries. As a result, companies relocate their production processes to non-EU countries where there is less or no CO2 tax, or they replace EU products with imported goods from third countries that have higher emissions. This process does not reduce greenhouse gas emissions; it merely shifts them to countries with lower climate protection goals.

The goal of the CBAM is to prevent these circumventions by requiring that a CO2 tax equivalent to the EU carbon price be paid when importing CBAM-covered products into the EU. In the future, companies will need to purchase CBAM certificates to validate the amount of carbon tax calculated. This system is a crucial part of the EU’s package of measures as it helps ensure a fair distribution of costs, transforms corporate models, and ultimately contributes to the fight against climate change. The first phase of the related CBAM regulation has already come into effect.

What's important when you want to import/export goods?

Every country has its own customs and tax system, which defines the customs clearance process, customs and tax rates, and customs regulations. Therefore, if you plan to export or import, it is advisable to check what laws are prescribed in your country for this purpose. The laws stipulate how and when to submit customs declarations, in which the importing or exporting party declares the value, type, origin, and tariff number of the goods. The tariffs are crucial as they determine the customs duty that must be paid. The regulations also detail the applicable taxes and the conditions for payment, ensuring transparency of tax burdens.

When transporting dutiable goods, it is important to pay attention to the accurate and complete filling out of data! If customs authorities find issues, they may impose various penalties as a consequence! For example, if the customs declaration is incorrect, the documentation is incomplete, or the taxes have not been paid, businesses may receive fines. These costs can impose a serious burden on companies and may threaten their operations!

In more severe cases, if illegal trade practices are involved, the goods may be withheld or confiscated, meaning that customs authorities can seize them! Therefore, it is essential for businesses to pay close attention to customs and tax regulations and ensure that they comply with all requirements during the customs clearance process.

Documentation

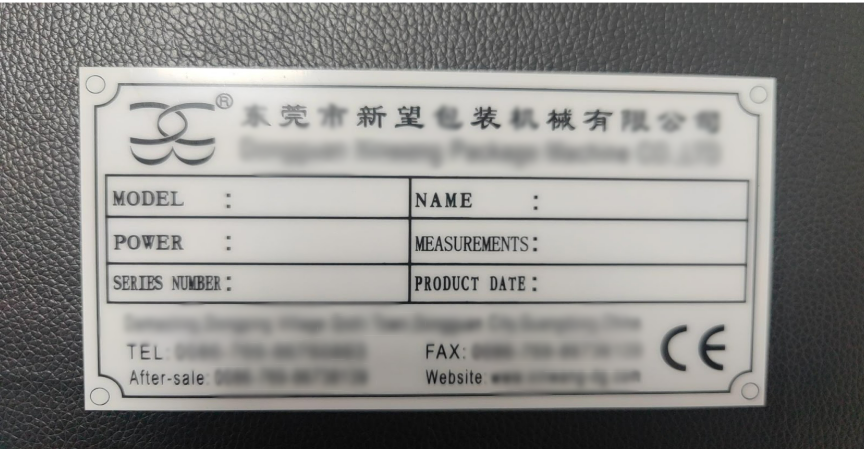

It is important for the product to have a data plate that includes: the name of the manufacturing company, its location and contact information, including a phone number, the name and specifications of the manufactured product, as well as the CE marking. Here you can see an example of a data plate:

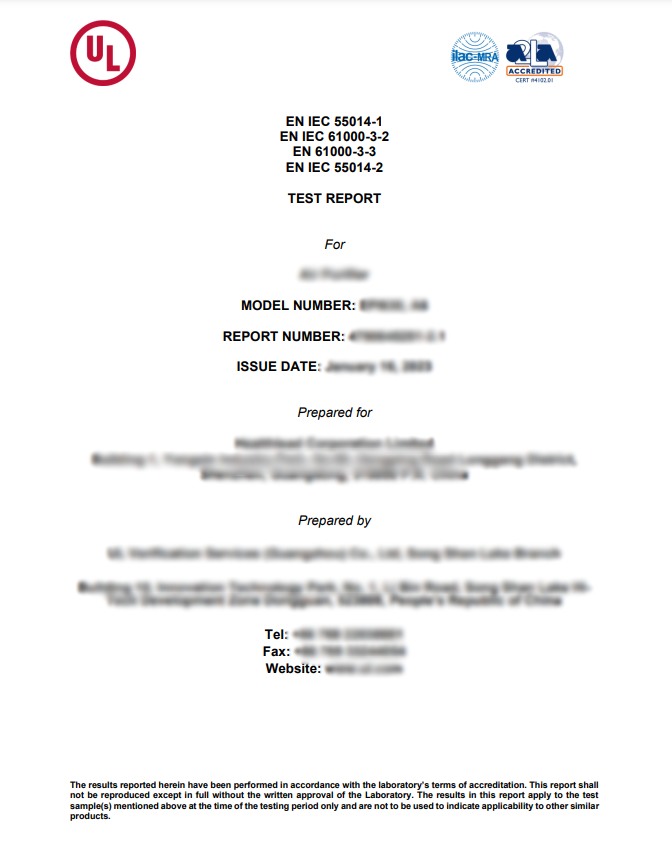

In many cases, companies exporting to the EU do not have the necessary CE certificate; in such cases, a document called a Test Report accompanies the goods, which serves as a preliminary step to the CE certificate, but does not replace it. If the exporter only has this document, always seek our assistance for a customs officer to examine whether it may be sufficient for domestic free circulation. The report includes the product name and manufacturing details.

The Test Report is a multi-page document, and here you can see an example of it:

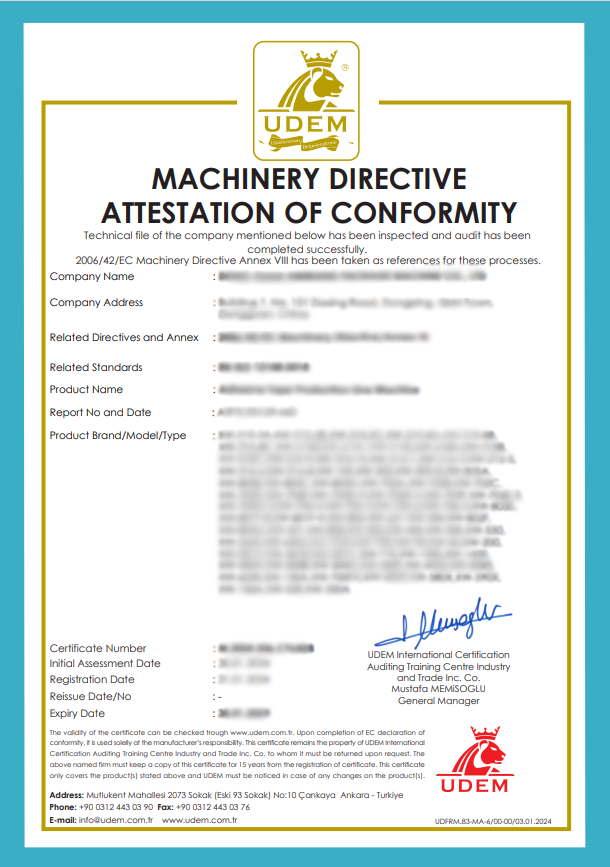

For free circulation in the European Union, an EU Conformity declaration may also be required. This is necessary if the product does not have a CE certificate. Here’s an example for it:

CE marking

During customs clearance, the compliance of products plays a particularly important role, which is indicated by the CE marking. This marking guarantees that the goods meet the safety, health, and environmental requirements of the European Union, thereby making it a fundamental requirement for successful importation and sale in the markets of the European Union member states.

How can a product obtain the CE marking?

Obtaining the CE marking generally involves several steps, such as:

Mapping the compliance requirements of the product: The first step is to understand the relevant European regulations and standards.

Preparing technical documentation: A detailed technical documentation of the product must be compiled to demonstrate compliance.

Third-party testing: For certain products, independent testing is also required to ensure the appropriate quality. (Test report)

Marking the product: Once the product meets all requirements, the CE marking must be affixed to it.

Here you can see an example of a CE marking certificate:

Unfortunately, it is now possible for the manufacturer to falsify the CE Certificate for easier sales, which is why it is important to always verify its authenticity.

What happens, when they are holding back your goods?

First of all, it is necessary to store the goods in a customs warehouse. This incurs costs, and you should also account for high daily fees for storage. If you obtain and present the appropriate documentation in time, your goods will be released for free circulation. However, if you are unable to obtain the documentation, you will either have to return the goods to the manufacturer, possibly sell them to a third country, or the National Tax and Customs Administration may require their destruction. In this case, you will have to account for the high costs of destruction, as you will not only need to pay for the procedure itself but also for the accompaniment by the tax office staff, waste disposal fees, and not to mention that you will have to write off the total procurement cost as a loss.

How can you avoid these unnecessary costs?

Even before purchasing the goods, it is advisable to ensure that the desired product has the necessary documentation. If you are uncertain or need assistance with customs clearance, feel free to reach out to us! INCON-LOGISTIC Ltd. has several years of experience in the field of customs and can provide solutions to any problem with its expert background. We are available for practical tips and advisory consultations!

Don’t hesitate, contact us – together we will find the best solution!