Customs management

Leave the entire process to us!

Customs clearance and management with expert support!

Do you need assistance with customs clearance processes? Are you ordering goods but uncertain if they will be cleared through customs? Or perhaps you’ve encountered a problem and your shipment is stuck in customs clearance? With over 20 years of professional experience in logistics, we are happy to assist you with every step of the customs clearance process. Please fill out our form, and we will get in touch with you as soon as possible!

- 24/7 availability

- Complete transparency

- Customer-centric approach

- High level of security

Logistical solutions that arise during international shipping

When transporting dutiable goods, it’s important to ensure that the information is completed correctly and completely! If customs authorities find issues, they may impose various penalties as a consequence! For example, if the customs declaration is incorrect, the documentation is incomplete, or taxes have not been paid, businesses may face monetary fines. These costs can pose a serious burden on companies and potentially jeopardize their operations!

What documents might you need?

It is important to have a data sheet on the product that includes: the manufacturer’s name, location, and contact information, including a phone number; the name and specifications of the manufactured product; and the CE marking. Here you can see an example of a data sheet:

In many cases, companies exporting to the EU do not have the necessary CE certification; in such cases, a document known as a Test Report accompanies the goods, which serves as a preliminary step toward the CE certification but does not replace it. If the exporter only has this, always seek our assistance to have a customs colleague examine whether it may be sufficient for domestic market clearance. The report includes the product name and manufacturing details.

The Test Report is a multi-page document; here you can see how it should look:

For placing goods into free circulation in the European Union, an EU Conformity Certificate may also be required. This is necessary if the product does not have a CE certification. Here you can see an example of how such a document looks:

During customs clearance, the compliance of products plays a particularly important role, which is indicated by the CE marking. This marking guarantees that the goods meet the safety, health, and environmental requirements of the European Union, making it an essential requirement for successful import and sales in the markets of EU countries.

The marking is an important legal requirement in the European Union, indicating that a product complies with the safety, health, and environmental regulations set by the EU. Manufacturers, distributors, and importers are responsible for the compliance of their products, and the CE marking can only be affixed to products that meet the relevant legislation. Additionally, appropriate technical documentation must be prepared for the products, demonstrating their compliance, safety, and reliability. We will show you what a correctly filled out CE Certificate looks like:

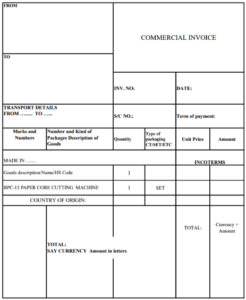

During customs clearance, the accurate completion of invoices plays a key role in the seamless passage of goods across borders. A properly filled invoice not only meets the requirements set by customs authorities but also contributes to the faster processing of transactions and helps avoid delays. We will show you the principles of proper invoice completion, the necessary information, and the most common mistakes to avoid. Our goal is to provide a helping hand to all those who wish to ensure a smooth and efficient process during customs procedures.

The invoice must include the details of both the issuer and the recipient. It is crucial to ensure that the information is accurate and relevant! The date of the invoice issuance and its serial number are also key pieces of information. Information regarding the goods must be completed, such as the unit price, quantity, and total amount. It is very important not to forget to indicate the currency in which the invoice is to be settled! Without this, the invoice will unfortunately not be accepted. We should also provide the payment method and deadline. In addition to the exact name of the product, its country of origin must also be specified. At the bottom of the invoice, we should write out the total amount in words, and don’t forget to indicate the currency in which the payment will be made.

Have an urgent question?

Call us: + 36 84 580 048

Choose INCON-LOGISTIC Ltd. for precision international shipping solutions!

If you need any more changes or have additional content, just let me know!

The INCON-LOGISTIC team possesses outstanding expertise in customs clearance and customs management as well. Our staff’s experience guarantees that we can successfully handle complex, unique assignments by road and rail. We provide continuous (24/7) availability, cargo traceability, consultancy, and security.

Value Added Tax (VAT) and Goods and Services Tax (GST) are forms of taxation used in different parts of the world, aimed at imposing a tax burden on final consumption. While there are many similarities between them, significant differences can also be found in their application across various countries.

VAT, which is prevalent in Europe and many other regions, such as Hungary, is a consumption tax imposed at every stage of the supply chain for goods and services. Ultimately, the tax is paid by the consumer; however, businesses submit VAT returns and payments based on their revenues and expenses. It is important for companies to reclaim VAT paid on their purchases, which helps to minimize the net VAT burden.

In contrast, the Goods and Services Tax (GST) has been implemented in countries like India, Canada, and Australia. Similar to VAT, GST is applied throughout the entire supply chain of goods and services. However, the structure of the tax and the method for reclaiming it can vary depending on the specific characteristics of each country.

The most significant difference between the two taxes lies in their naming, which can influence the fundamental rules and application of the system. The economic environment, tax rates, and regulatory frameworks can positively or negatively affect how businesses operate in terms of taxation.

Overall, VAT and GST reflect the same consumption tax applicable to final sales. However, understanding the differences between the two systems is essential for the smooth conduct of international trade and business. Due to the regionalization of tax systems, it is important for businesses to be aware of the variations and the regulations in their own countries.

Paying customs duties and taxes is an important step in international trade, ensuring that goods can pass smoothly across borders. Below is an overview of how you can pay these duties to make the process seamless.

First, customs duties and taxes are typically due when goods are imported. The initial step is to complete a customs declaration, which includes a description of the goods, their value, and the country of origin. This declaration is usually submitted electronically to the customs authority.

After submitting the customs declaration, the customs authority assesses the applicable customs duties and tax entitlements for the goods. The duty rate is generally calculated based on the value of the goods and their customs code (HSN code). Subsequently, the customs authority will inform you of the amount to be paid.

The payment of customs duties and taxes can be made in several ways. First, most countries allow the use of bank transfers, which offer a quick and secure method for transferring amounts. Additionally, in some cases, online payments are available, allowing you to settle your dues easily through the customs authority’s website.

After paying the customs duties and taxes, you will receive documentation confirming the customs clearance, which may be required for further movement of the goods. It’s important to keep these documents, as they may be needed during future inspections.

In summary, paying customs duties and taxes is a process that involves completing the customs declaration, calculating the taxes, and settling them via bank transfer or online. By taking the proper steps, you can ensure that goods pass quickly and smoothly across borders, thereby facilitating your business activities.

Customs duties and taxes must be paid in the following cases:

- Importing Goods: Customs duties and taxes are generally required when goods are imported into a country. This process occurs as part of customs clearance, and the buyer or importing party must pay the applicable duty and VAT before the goods arrive at their destination.

- Submitting the Customs Declaration: Payment of customs fees is due at the time of, or after, submitting the customs declaration. The customs authority calculates the amount to be paid based on the customs declaration.

- Delivery and Transfer Periods: The timing of customs duties and tax payments may vary depending on the regulations of each country’s customs authorities. Typically, payments should be made in accordance with the rules related to the submission of the customs declaration and the crossing of borders by the goods.

- Late Fees: If customs duties and taxes are not paid on time, late fees or penalties may arise. Therefore, it is important to adhere to deadlines.

Based on this, it is essential for importers to be well-informed about local customs and tax regulations to ensure that the necessary payments are made in a timely and appropriate manner.

During the payment and management of customs duties and taxes, several issues may arise that can affect business operations and international trade. Below are some of the most common problems:

Determining Customs Value: Establishing the correct customs value is a common challenge, as customs authorities strictly scrutinize the value of goods. In cases of incorrect declarations, penalties may be applied, and the duty may be corrected, imposing financial burdens on businesses.

Insufficient Documentation: A lack or inaccuracy of the necessary documents for customs clearance (such as invoices, proof of delivery) can cause delays and incur additional costs. Proper documentation is essential for seamless customs clearance.

Misunderstood Customs and Tax Rates: Different countries apply varying customs and tax rates; therefore, due to incorrect information or misinterpretation, importers may not pay the correct amount, resulting in further complications.

Delays and Late Fees: Delays in the customs clearance process, such as processing the customs declaration for goods, can lead to bank fees and late charges, increasing business costs.

Changing Regulations: Customs and tax regulations in different countries can frequently change, making it difficult for businesses to remain compliant. Awareness and adherence to new regulations are vital to avoid legal issues and fines.

Sanctions and Penalties: Violating customs and tax regulations can result in sanctions or fines that can severely impact business operations.

To prevent these issues, it is advisable to thoroughly understand customs and tax regulations, maintain accurate documentation, and seek professional advice if necessary to ensure a smooth customs clearance process.